IAB Australia updates Programmatic DOOH Buyers Guide

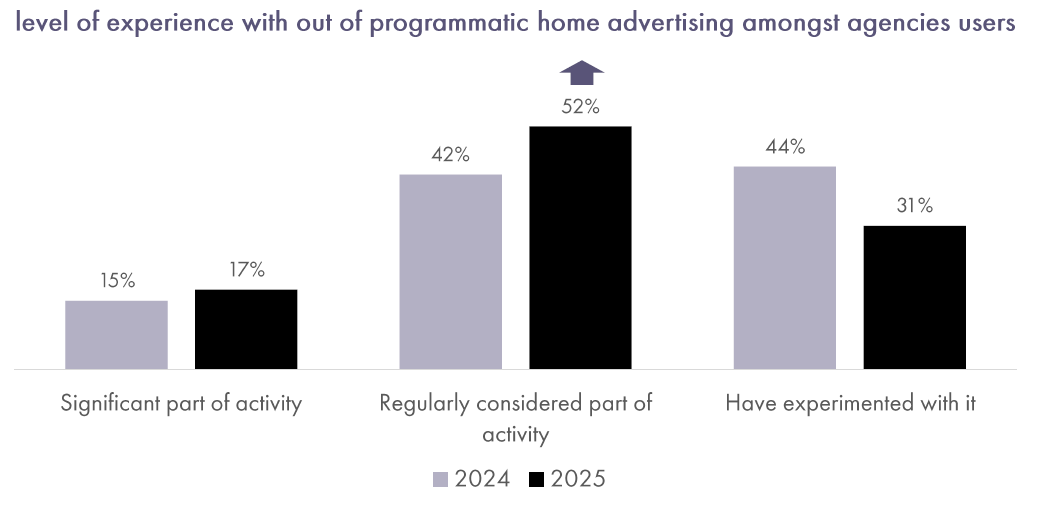

Australian agencies are increasingly using programmatic digital out of home advertising, moving from experimentation to regular consideration in campaign planning according to the IAB Attitudes to Programmatic Digital-Out-of-Home report released today. A similar trend is occurring in Europe, with agencies there identifying pDOOH as the top programmatic growth area for 2025.

While agency understanding of pDOOH was found to have increased since last year, 36% of agencies believe that both a general lack of understanding and specific lack of understanding of the cost versus benefit are preventing pDOOH from gaining a larger share of ad volume and investment. To address this issue and support the developing market, the IAB Australia DOOH Council has also released an updated Programmatic DOOH Buyers Guide to provide practical tools for buyers, sellers and tech partners.

Gai Le Roy, CEO of IAB Australia, commented “It’s encouraging to see continued growth in programmatic DOOH investment, combining the strengths of digital advertising with the impact of out-of-home. However, as investment builds, agencies and brands are increasingly seeking more guidance on performance and effectiveness, as well as the role of technology and data. The updated IAB Australia Programmatic DOOH Buyers’ Guide has been developed to support this need.”

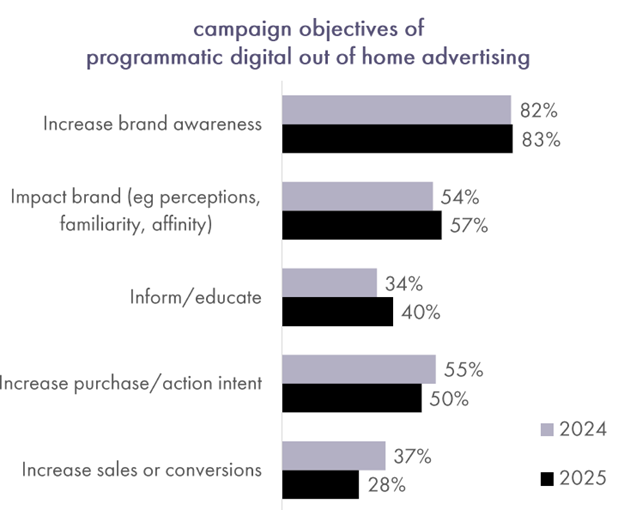

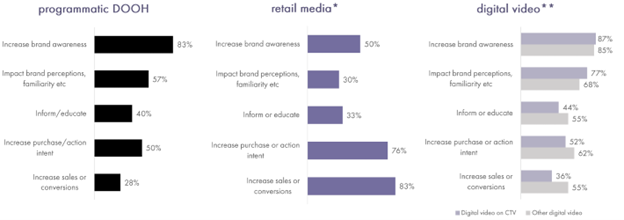

Agency use of pDOOH for top and mid funnel campaign objectives increased slightly from 2024 with 83% of respondents seeking to increase brand awareness in 2025, while 57% used it to build brand impact and 40% to inform or educate. By contrast, the number of agencies using pDOOH for sales or conversions dropped from 37% in 2024 to 28% in 2025, and its use to drive purchase action or intent decreased from 55% to 50%.

The Report found that 81% of agencies now plan OOH, DOOH and pDOOH advertising within the same team, and 68% frequently or sometimes align pDOOH buys with digital video activity. Geo-location targeting, flexible buying options and the data and targeting capabilities were identified as the major drivers of pDOOH.

Additional findings include:

While campaign audience and volume remain the top tools for assessing the effectiveness of pDOOH campaigns, the use of Market Mix Modelling jumped from 32% in 2024 to 51% in 2025 as marketers seek to put their pDOOH investment performance in context with the rest of their media investments.

42% of agencies are exploring DOOH AI use cases for identifying and segmenting audiences. This rate of AI use case exploration is lower when compared to broader media campaign lifecycle AI use case testing. (according to the recently released IAB Data State of Nation).

Nearly 64% of agencies think DOOH advertising opportunities will be impacted by future Australian privacy legislation reforms.

Sustainability is not seen as a barrier to investment in pDOOH with 45% of Australian agencies having at least some strategic focus on reducing carbon emissions in programmatic investment. This is however much lower than European agencies at 83%.

The IAB Attitudes to Programmatic Digital Out of Home Advertising Industry Report surveyed 116 advertising agencies in Australia with the aim of understanding the state of play for programmatic and all digital out of home media trading in Australia. Conducted in July and August 2025, the study explores the needs of buyers as well as the opportunities for growth. The report will be used by the IAB DOOH Council to prioritise the development of industry standards, resources and education. Similar surveys were conducted in 2021, 2022 and 2024.

The IAB DOOH Council includes representatives from JCDecaux, Blis, Broadsign, Cartology, Enigma, Google, Howatson+Company, Jolt Charge, MiQ, OMA, oOh!media, Perion QMS, Scentre Group, SpotLumos, The Trade Desk, Thorndyke, Tonic Health Media, Val Morgan Outdoor, Veridooh, VIOOH, Vistar Media, WPP Media and Yahoo.

Images

/Ends

About the Interactive Advertising Bureau

IAB is an independent industry association with nearly 9,000 members globally spanning media owners, publishers, technology companies, agencies, and advertisers. It works to align industry stakeholders to develop solutions for the issues faced by the market and develop standards that are integral to the operation of digital advertising.

As one of 45 IAB offices globally, the role of the IAB is to support sustainable and diverse investment in digital advertising across all platforms in Australia as well as demonstrating to marketers and agencies the many ways digital advertising can deliver on business objectives.